Are you interested in a profitable sports betting solution that doesn’t have any risk of account gubbings? In this Mercurius Trader review, I will show you what has long been considered the holy grail by many: passive, profitable sports betting without any chance of account closures.

Perhaps you’ve tried matched, arbitrage and value betting but have found that your accounts are getting increasingly limited by the soft bookmakers?

Or you are interested in the idea of profitable sports betting but don’t have the time to place the bets yourself?

That’s where the Mercurius Trader product comes in. Keep reading this Mercurius Trader review to find out more.

Note: Unlike arbitrage and matched betting, with Mercurius Trader your profits are not guaranteed and your capital is genuinely at risk. Mercurius do their best to reduce these risks but they are still present. Click here to read more about the risks.

Before we go any further...

To make sure that I’m not wasting your time, let’s make sure you satisfy the minimum requirements to be a Mercurius Trader customer.

Mercurius is only suited to customers which meet the following requirements:

- Have access Betfair.com account*

- Are willing to invest at least £1,000

- Have a long term investment outlook and are comfortable with some risk and volatility

If this is you, great! Keep reading to find out more about Mercurius Trader!

Otherwise, I recommend that you look at other forms of profitable sports betting, such as arbitrage, matched or value betting.

*Note: The Mercurius Trader model relies on a Betfair commission of 2%. Betfair.com have agreed to provide this to all Mercurius customers, but other Betfair domains (.com.au etc.) have not offered this to Mercurius, so they cannot accept customers from these countries.

Feel free to contact [email protected] to check if your country is supported and if you can receive the discounted commissions

Ineligible Countries

Residents of the countries below are not eligible to become Mercurius Trader customers as they are unable to access the Betfair.com platform.

- Afghanistan

- Algeria

- Angola

- Australia

- Austria

- Belgium

- Brunei

- Bulgaria

- Bulgaria

- Canada

- China & Hong Kong

- Columbia

- Cyprus

- Czech Republic

- France (and French Territories)

- Germany

- Greece

- Greenland

- Guyana

- India

- Iran

- Iraq

- Israel

- Italy

- Kuwait

- Lao

- Libya

- Myanmar

- Namibia

- New Zealand

- North Korea

- Papua New Guinea

- Poland

- Portugal

- Saudi Arabia

- Singapore

- Slovenia

- South Africa

- Spain

- Sudan

- Sudan

- Switzerland

- Syria

- Turkey

- Uganda

- USA (and US Territories)

- Yemen

- Zimbabwe

What is Mercurius Trader?

Mercurius Trader is a product that is designed to convert sports betting into an asset class that you can invest in, much as you would with the stock market.

It uses an in-house, artificial intelligence model to perform a quantitative analysis of millions of data points to come up with an estimate of the probability of an outcome occurring. Based on these probabilities, it establishes what it considers to be ‘fair odds’.

Where the market deviates from these ‘fair odds’, they identify value and place bets, with the aim of profiting in the long run. Not every bet will win, of course, but by having a slight edge over the market each time, they expect to profit in the long run.

They work exclusively with Betfair, the world’s largest betting exchange, meaning that you will never get gubbed or have your account closed. Betfair actually welcomes Mercurius Trader users as they provide significant liquidity on the platform.

Is This Just Another Tipster Service?

No, for two reasons.

Firstly, they aren’t making bets based on their ‘gut feel’, but rather based on a quantitative mathematical model that they developed over a period of 4 years.

The bets placed by the model have been publicly available since release in February 2019 and can be scrutinised by anyone (more on this later).

Unlike many tipsters, their performance and methodology are open and transparent, and they have back tested their strategies over a period of many years.

Secondly, you do not need to place the bets yourself. After depositing your starting bankroll into your Betfair wallet, you use the Betfair App Directory to grant Mercurius access to your wallet.

Mercurius Trader will then execute bets on your behalf based on the findings of their model. There is no time investment required from you at all.

You can access your dashboard at any time to check on your performance and bet history, as well as stop/resume betting on your behalf by Mercurius. Otherwise, it is a set and forget investment.

How does the Mercurius Trader model work?

This model was developed using findings from a wide variety of publicly available studies and research into the field of football match prediction (typically university PhD projects).

If you want to get technical, they use what is known as a Bayesian hierarchical model with machine learning algorithms. The model focuses exclusively on football betting and fundamentally aims to determine the expected number of goals that a particular team will score (known as an expected goal, or xG model).

It then also calculates an offensive and defensive rating for each team.

Combining all of these, it uses Monte Carlo methods to simulate around 100,000 matches between the two teams in question.

It uses this incredible number of simulations to generate a probability for each particular outcome, and therefore generate what it considers to be ‘fair odds’. When the market deviates from these odds, the AI identifies value and begins executing bets across all customer accounts.

You can find out more in the 1 minute introductory video by Mercurius below.

What kind of data does it base its calculations on?

Mercurius Trader sources its data from WyScout, a platform that collects incredible quantities of data from professional football matches and makes it available to companies such as Mercurius, for a price.

This data includes information about ball tracking (location, speed, height), every touch of the ball by a player (location, body part) as well as every shot on goal (distance from goal, body part used, speed, angle of shot) as well as much, much more.

All of this data feeds into the Mercurius Trader model. As it incorporates machine learning, the model is constantly updating and adapting to new data that it receives.

To increase the likelihood of long term success, the model has been designed to operate only on football betting for large league matches.

By having such a tight focus, the Mercurius team can dedicate their resources much more effectively and find greater edges (value) than if they spread themselves over multiple sports, leagues and markets.

They don't just bet on anything that has positive expected value, but they aim to maximise the ratio of return on capital to max drawdown of capital (essentially trying to get good returns with minimal volatility).

See the full list of leagues they operate on below.

- Premier League (ENG)

- Superliga (ARG)

- Bundesliga (GER)

- Ligue 1 (FRA)

- La Liga (ESP)

- Superleague (CHN)

- Eredivisie (NLD)

- Premier League (RUS)

- Championship (ENG)

- Primeira Liga (PT)

How do they place bets on my behalf?

As mentioned earlier in this Mercurius Tradr review, you can use the Betfair App Directory to give them access your Betfair wallet. This is possible because they are registered with the Betfair Vendor Program.

When the model identifies value in the market, it will begin executing bets across all customer Betfair wallets.

Unfortunately, Betfair does have a finite liquidity for a particular bet at a particular set of odds. Mercurius Trader only place back bets on large league matches, which have the greatest liquidity, but there can still be issues with odds slippage.

Odds slippage occurs when not all customers are able to access the best available odds due to insufficient liquidity.

As Mercurius Trader’s customer base has grown, the funds under management has grown too, which makes it more difficult to avoid slippage.

They use a number of strategies to avoid slippage and general disruption of the market. Firstly, they split the wagers and stage them at certain time intervals, to give the market a chance to replenish liquidity. They give priority to customers with higher bankrolls in this process.

Secondly, if there is slippage while executing bets and the value shifts from one outcome to another, they will shift the remaining unexecuted bets to this new outcome, provided that there is still positive expected value.

What are the risks of using Mercurius Trader?

It is absolutely critical that you understand the risks associated with Mercurius Trader before signing up. Unlike arbitrage and matched betting, your profits are NOT guaranteed and your capital is genuinely at risk.

With arbitrage and matched betting, you know what your profit will be before the match begins as you have mathematically engineered a profit based on the odds and your stakes.

This is not the case with Mercurius Trader, as they are using quantitative analysis to determine inefficiencies in the market.

This exposes us to the potential risks outlined below. Mercurius have considered these risks and have adopted a number of measures to mitigate them.

For each risk in orange, there is a mitigation measure in blue.

Underlying model risk

Poor model

If the model developed by Mercurius is using poor or false assumptions as its underlying basis, the ‘inefficiencies’ that it finds will end up not being inefficiencies at all and the resultant probabilities and ‘fair odds’ that it calculates will be incorrect.

Consequently, the bets that it places will not represent positive expected value, but rather negative expected value, leading to destruction of your capital over time.

Careful model development with rigorous back testing

Mercurius Trader spent a period of 4 years developing their model, basing it off reliable, high quality research published by reputable universities.

After finishing their model, they backtested it against 4 years worth of historical data to make sure that it would have historically been profitable.

They continue to update and tweak their models as new research is released by academics.

In addition, their own internal R&D team continues to make new findings, patent them, and integrate them into the model. In this way, they have built upon the findings by the academic papers and enhanced them with their own research.

Input data risk

Bad input data

Even if the underlying assumptions of the Mercurius model are correct, if the data it bases its calculations on are inaccurate, it will produce inaccurate conclusions.

This could again lead to the placement of EV negative bets.

Source data from reliable sources only

They source data from WyScout, one of the most trusted and reliable football analysis services out there.

This substantially decreases the likelihood of feeding bad input data into the model. They are in close contact with WyScout (based in Italy like Mercurius) at all times.

They also periodically extract samples of the WyScout data and confirm its validity. This is an extra layer of quality control.

Probability risk

Bad luck

As with all expected value betting, luck plays a part. Even if every bet that is placed has a positive expected value, there will be periods of high profits and periods of losses.

The greater the number of bets we place, the more we increase the likelihood of achieving a statistically significant outcome (ie. our profit converging on the long term expected value, which is positive), but we also increase our likelihood of going bust at some point along the journey.

The ideal stake for maximising profit on each bet follows the Kelly Criterion, which is typically a proportion of the current bankroll.

As your bankroll increases, your stake per bet should increase proportionally, which means that your risk never diminishes and that being wiped out by an unlucky string of bets (despite the fact they may have all been EV positive) is an ever present danger.

Careful staking plan

To minimise the risk of losing your entire bankroll, Mercurius have tested a number of staking plans. Ultimately, they have settled on using a 1% Kelly staking plan, which is a balance of risk and reward.

A true Kelly staking plan tends to result in overbetting, increasing the risk of losing your bankroll.

By capping bets at 1% of the staking plan, this risk is reduced significantly.

Sequencing risk

High variance in returns (at time of withdrawal)

As I just mentioned, even with EV positive bets, there will be variance in your returns over time.

If you invest with Mercurius Trader expecting to pull your money out in 6 months with guaranteed winnings, you are going to be sorely disappointed.

This is a long term investment, with a long investment horizon, meaning that you shouldn’t be investing if you have a desperate need to pull your money out at a certain time.

In all possibility, this time when you need to pull your money out may be during a period of poor returns, which is the worst possible time to withdraw your funds.

This variance can make it difficult for investors to know when they should start drawing down their profits.

Multiple models to choose from

As different customers will have different investment horizons and different risk profiles, Mercurius have recently allowed customers to pick from two different strategies, based on the same underlying model.

You can now select either the DynamoXG or PhoeniXG model for your account. Both of these are an improvement on their original models, which needed much more bets to achieve a statistically significant outcome.

DynamoXG is designed to maximise annual returns (with high volatility as a consequence), whereas PhoeniXG is designed to minimise periods of loss (with lower annual returns as a consequence).

You can choose the one which suits you best. Find out more about each of them here:

Mercurius Trader Review - What is their long-term performance?

Mercurius are very transparent about their performance. You can use the link below to access information about their performance since inception in 2019.

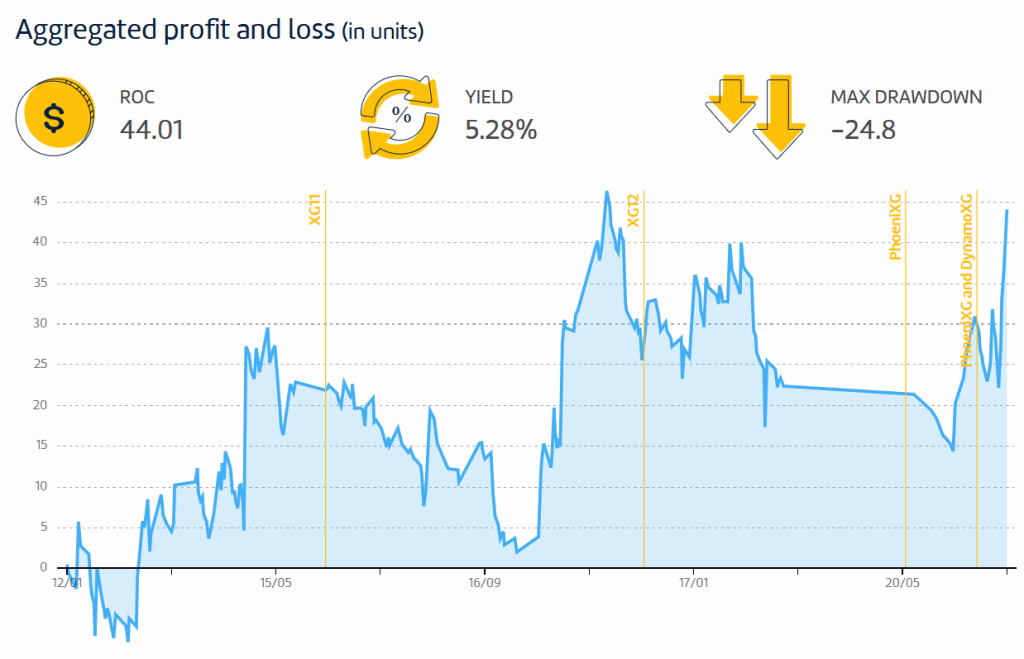

The graph below also shows performance since inception. Note that it is based on a flat staking plan of 1 unit per bet, whereas the actual model uses 1% of the current bankroll at any point in time.

Accordingly, your real performance varies depending on when you began investing with Mercurius.

Also, where there were instances of odds slippage, the performance is based on the lowest odds achieved by customers, to be conservative.

At the time of writing, Mercurius Trader has completed 834 bets with a strike rate of 32.25% and average odds of 4.32.

You can see a full, running list of bets they have made since inception via the Google Sheet below:

Looking at their performance graph above, the Return On Capital (ROC) figures look great, but they don’t really tell the full picture. ROC is a measure of the performance of your money based on the actual capital that was deployed in bets.

As Mercurius use a relatively conservative 1% Kelly stake per bet, the true Return On Investment (ROI) of your funds in your Betfair Wallet will be lower.

Another thing to be aware of when looking at the ROC figures is that because they are based on a flat staking plan, they may be overly optimistic.

Consider this. Say you have a starting bankroll of 100 units and are betting 1% per bet. You have a good streak of 10 wins in a row. As you are betting 1% each time, your stake will be increasing each time. We can calculate our returns like this:

Bankroll = 100 * (1.01^10) = 110.46

Say we then lose 10 bets in a row, betting 1% of the bankroll per bet. This leaves us with the following bankroll.

Bankroll = 110.46 * (0.99^10) = 99.90

A flat staking plan would suggest you went up 10 units, then down 10 units, leaving you back at 100. However, the compounding nature of the 1% staking plan means that the negative return periods hit harder.

This effect is amplified over hundreds of bets.

In any case, Mercurius have achieved a decent return since inception in 2019. Their DynamoXG and PhoeniXG models are still new, but you can view their performance during backtesting here:

You can also download their factsheet with more detailed statistics about their performance.

Pricing

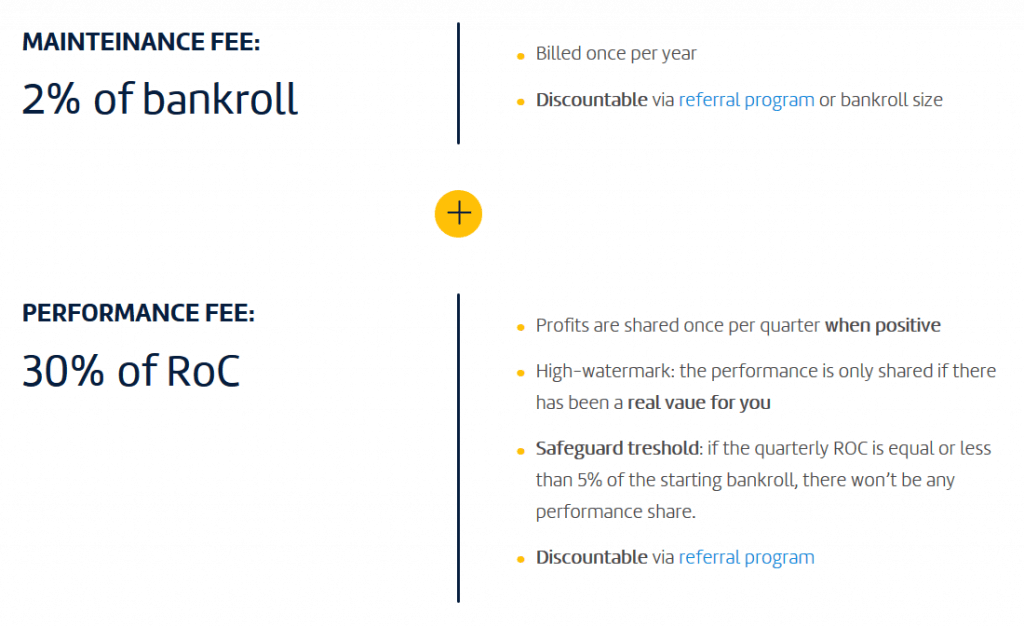

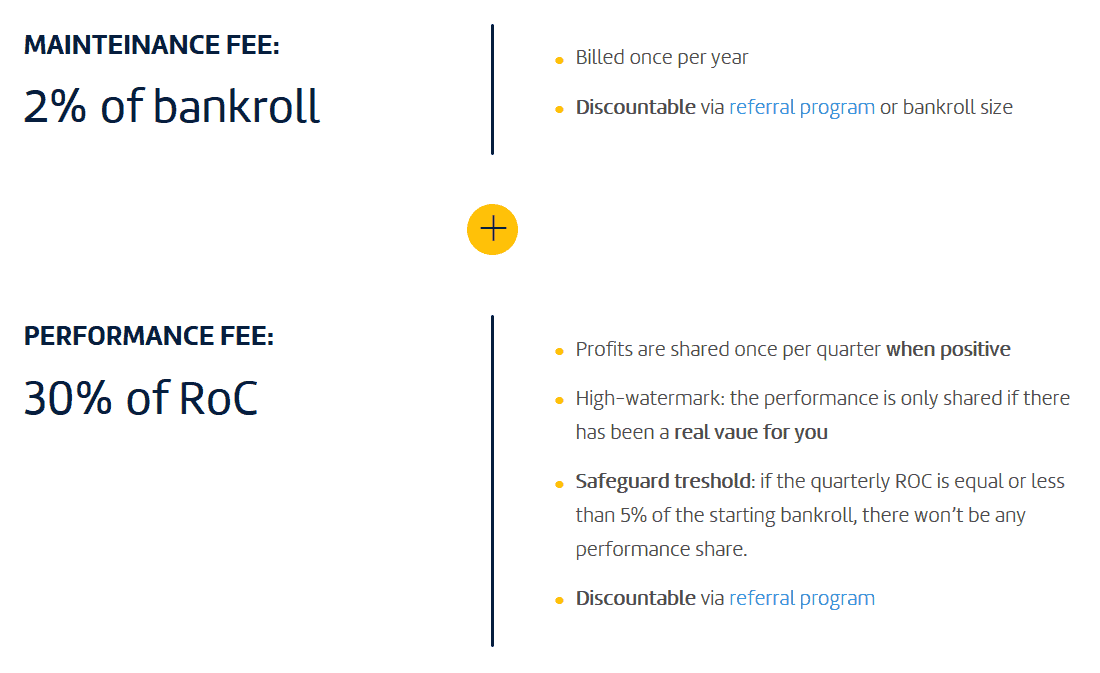

Mercurius have a pricing structure reminiscent of an investment fund, which makes sense when you consider that they are trying to turn sports betting into an investable asset class.

They charge two fees:

- A maintenance fee of 2% of your bankroll per year.

- A performance fee of 30% of your profits from the preceding quarter. If your bankroll has not increased by at least 5% relative to your starting bankroll, you will not be charged until it does exceed 5%.

Mercurius claim that the maintenance fee is designed to help them with their fixed costs (running servers and purchasing data) whilst the performance fee pays them their salaries/profits.

This keeps their interests aligned with yours. Everyone wants the model to be as profitable as possible, to maximise profits.

Note that Mercurius cannot make any withdrawals directly from your Betfair wallet. This means that all fees will be billed to you directly, whereupon you will pay via bank transfer or similar.

This means that all fees are kept separate from your bankroll. It is important that you budget appropriately for these fees.

Also be aware that Mercurius reserve the right to charge a 5% fee if the account is closed before 200 bets have been executed. This is to discourage customers from closing accounts soon after opening, before the model has had a chance to reach a statistically significant outcome.

Mercurius Trader Review - What are the Pros and Cons?

Hopefully you’ve seen by now that Mercurius Trader is a vastly different beast to the likes of arbitrage and matched betting.

It comes with its own set of unique pros and cons, which I will discuss below.

Pros

Entirely passive investment

Once you connect your Betfair wallet to Mercurius Trader, there is no further work required on your part at all (other than paying the quarterly performance invoices).

You can check your dashboard to see how your bets are performing as often as you like, but there is no need to do this.

Profits scale proportionally with bankroll size

Unlike arbitrage and value betting, where your profits are typically dependent on how much time you spend betting, with Mercurius Trader your profits are dependent on the size of your bankroll.

If you have built a decent bankroll using these other forms of profitable sports betting, you will see better results with Mercurius.

No risk of gubbings or account closures

Betting is done entirely on the Betfair platform, which does not ban or limit consistent winners. You can rest easy knowing that you will not wake up one day to find your stakes limited.

2 risk/reward strategies to choose from

The DynamoXG and PhoeniXG models offer different risk/reward models based on your personal risk preference and investment horizon.

Low minimum investment (£1,000) to get started

If you have built a bankroll using other forms of profitable sports betting, £1,000 will not be a problem for you to get started with.

2% Betfair commission

Mercurius have negotiated a deal with Betfair whereby all customers will receive a discounted commission of just 2% for football betting (except for Australia and New Zealand).

This is integral to the Trader model and is the reason why they can only operate in countries where Betfair allow them a 2% commission.

Note that you can still use your Betfair account while the Mercurius bot is active, and you can take advantage of the 2% commission on football bets in your personal betting.

Cons

Profits are not guaranteed. Your capital is at risk.

As I have mentioned, your profits are not guaranteed whatsoever, and are entirely dependent on the veracity of the Trader model.

Potentially lower profits than arbitrage or matched betting

If you have a low bankroll, you will see proportionally lower profits. With arbitrage and matched betting, you can make up for this by spending more time betting, but this is not the case for Mercurius.

Build your bankroll with these other methods, then come to Mercurius.

Only available to customers with access to Betfair.com

Unfortunately this excludes customers from many countries. Mercurius are in the process of developing another product which would suit customers who cannot access a Betfair.com account.

Long investment horizon

Due to the relatively small edge/value obtained with each bet, the model needs hundreds of bets for a statistically significant outcome.

Without this, there is a decent likelihood that your profits will not have converged on the long term expected value. This product is only for those who are willing to invest their money for at least a year.

Mercurius Trader Review - Conclusion

Mercurius Trader is a unique product with an ambitious goal - to turn sports betting into an investable asset class.

Those who have been involved in profitable sports betting for some time will certainly have a keen interest. Account gubbings and closures are a constant thorn in the side of those taking value from soft bookmakers, so a method that is free of these issues will be warmly welcomed.

But is it really a profitable form of sports betting? Or just lucky?

Well, time will tell. It is still early days for Mercurius, but they have achieved good results in their 1.5 years of operation so far, and their 4 year back testing period also shows very favourable results.

Their minimum investment amount is low and their fees are designed to only really apply if you are actually making a profit, so I recommend that you give them a go!

Remember to only invest what you can afford to lose.

However, if you are still new to profitable sports betting, I recommend that you start with matched betting or arbitrage betting to build your bankroll before moving onto advanced products such as Mercurius.

Once you have exhausted these opportunities, move onto Mercurius and they will help you grow your bankroll even further!

I hope you have enjoyed this Mercurius Trader review! If you have any questions, leave them in the comments below!

100% Free Video Course For Earning Money Online With Sports Betting

The most comprehensive, in-depth training on profitable sports betting available. Start earning an income online using the unique techniques in this free course.

(PS. Any particular interests? Check the boxes below before signing up!)

Disclaimer: This post may contain affiliate links. I will earn a commission if you choose to purchase a product or service after clicking on my link. This helps pay for the cost of running the website. You will not be disadvantaged in any way by using my links.

Reviewer: Louis

Review Date: 2020-07-26

Reviewed Item: Mercurius Trader

Author Rating: 4.5/5

Product Name: Mercurius Trader

Price: GBP £0.00

Product Availability: Available in Stock

Hi Louis, thanks for this review, much appreciated!

So Betfair isn’t available for people from Germany what do you think about using VPN?

Is Mercurius Trader better than TradeMate Pro? or RebelBetting value bet?

They are quite different products, actually. Mercurius Trader is a passive system, where you rely on a bot to do betting for you. With Trademate and RebelBetting, you are actively placing the bets yourself.

The profits for Mercurius are highly variable and depend on how good their bot is. For Trademate and RebelBetting, the maths suggests that you should win in the long run as long as you place enough bets.